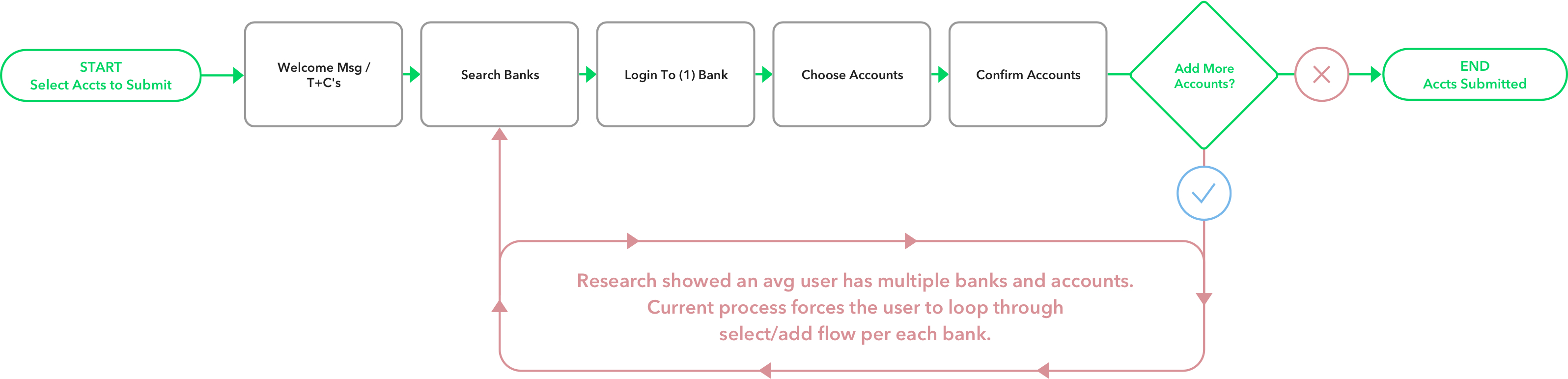

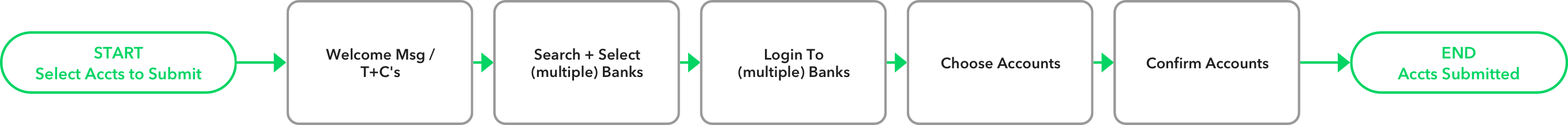

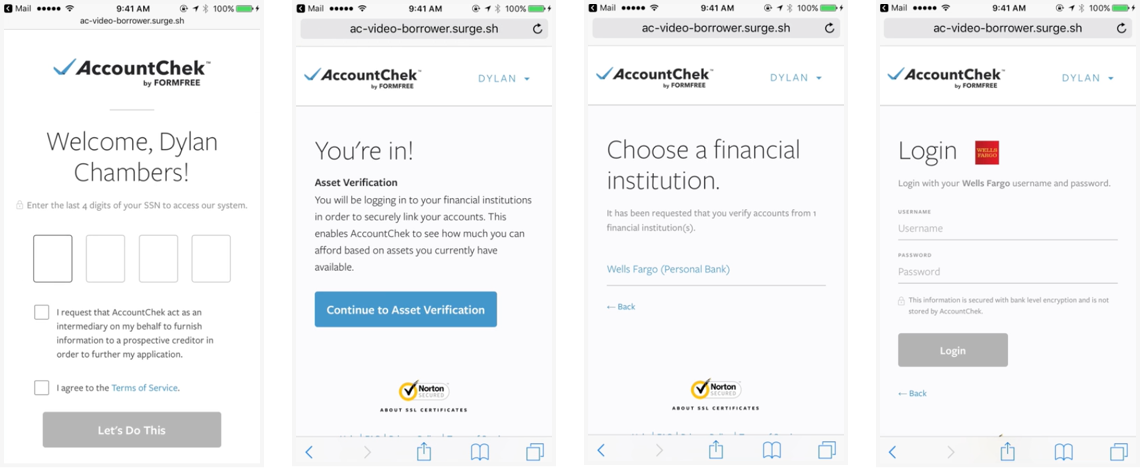

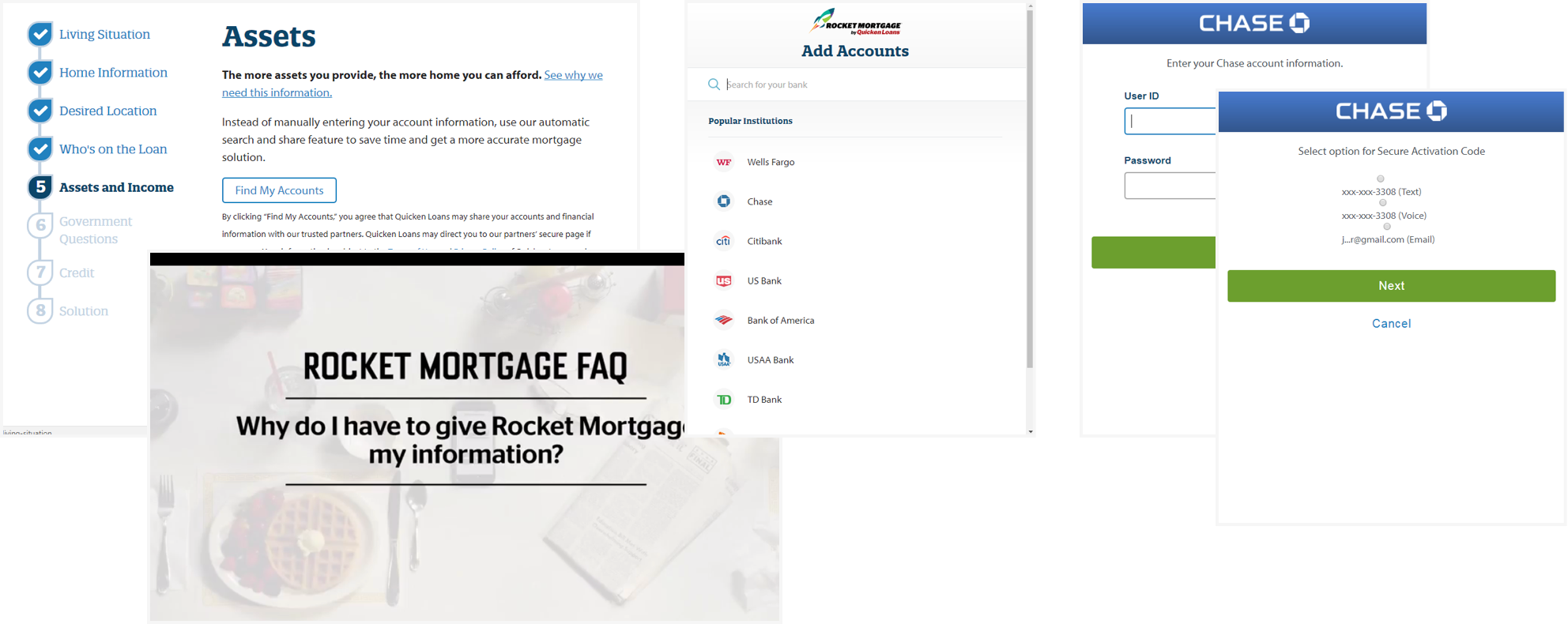

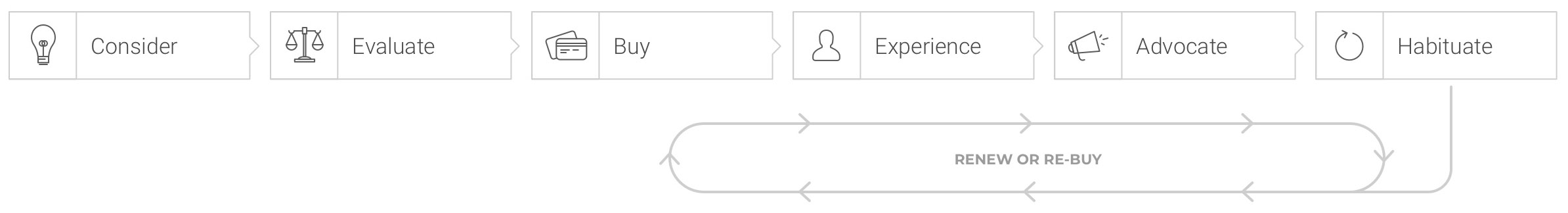

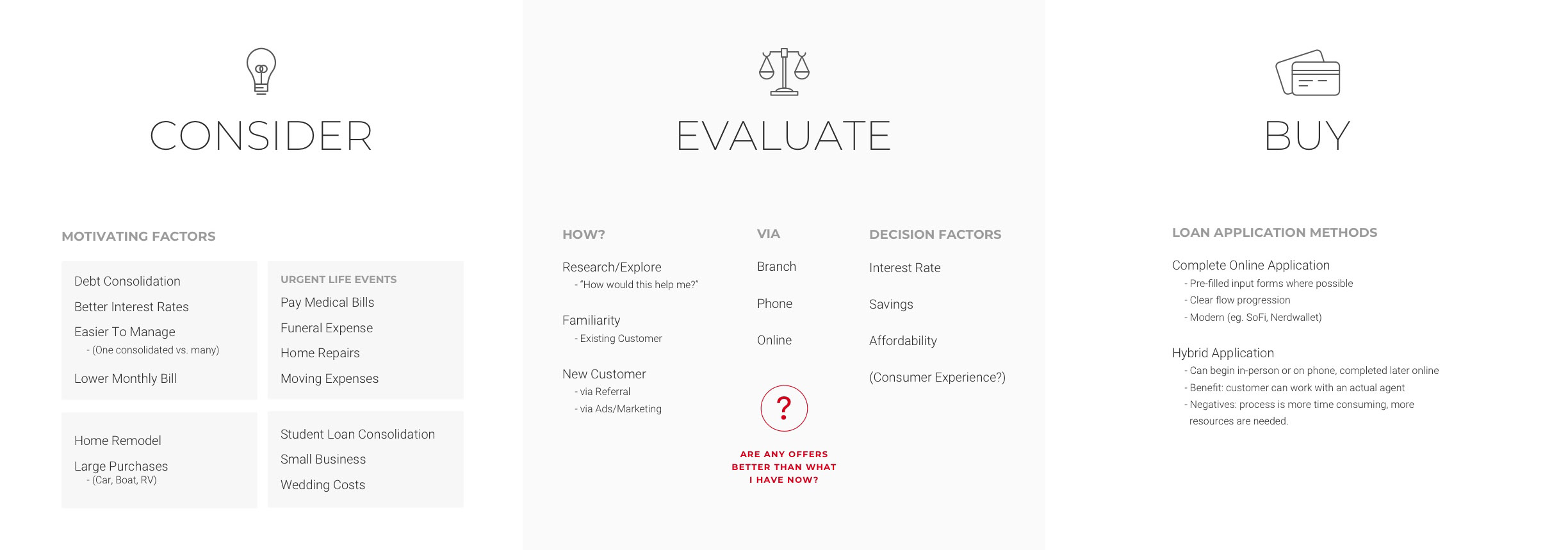

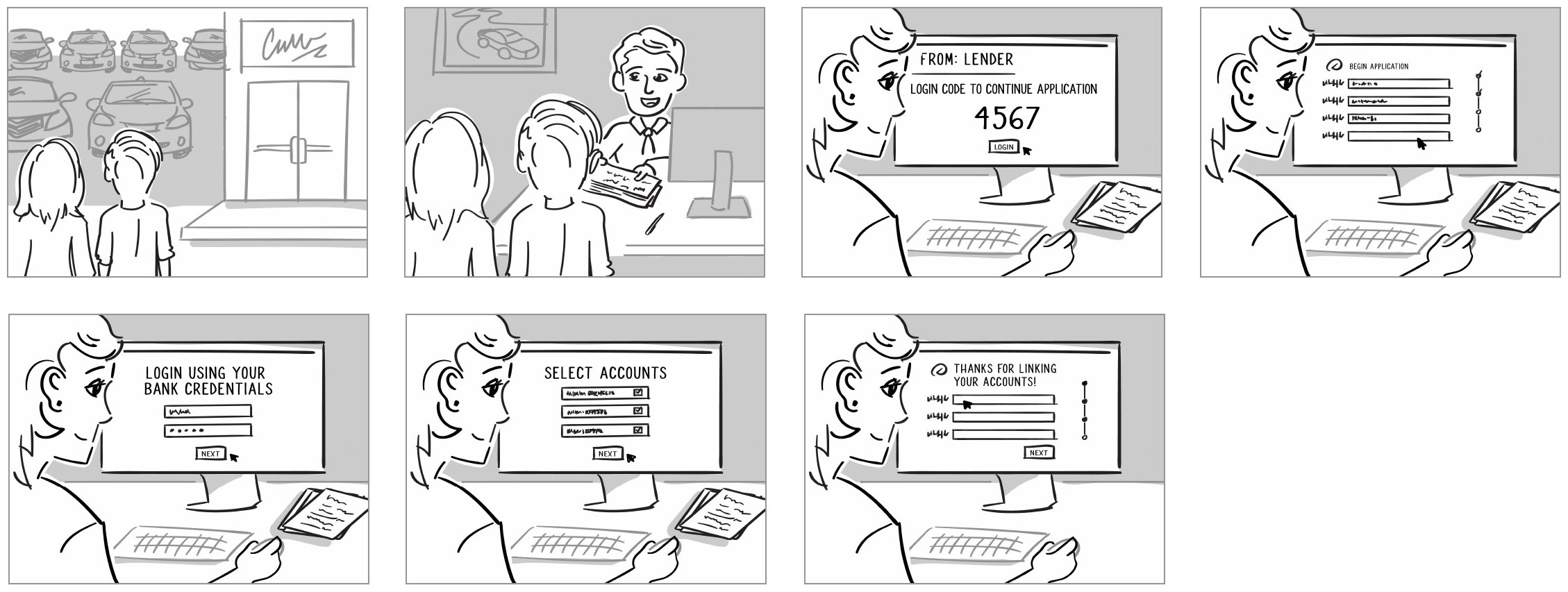

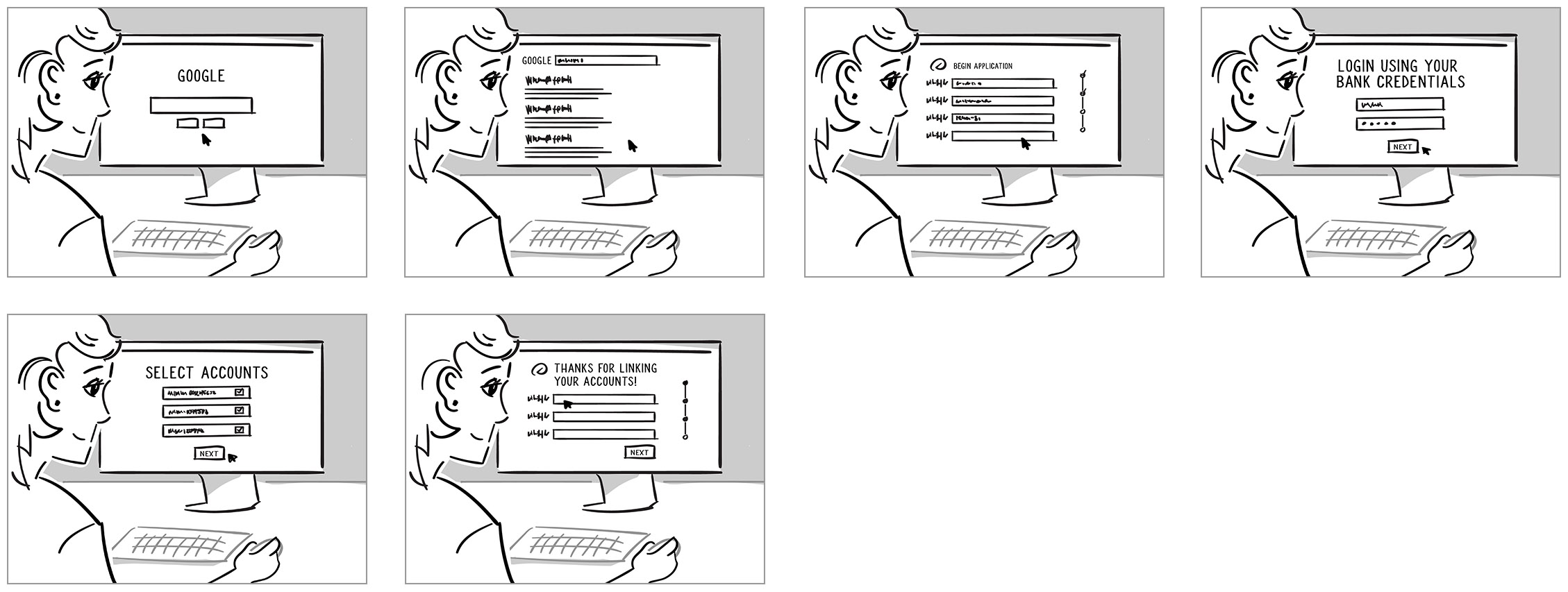

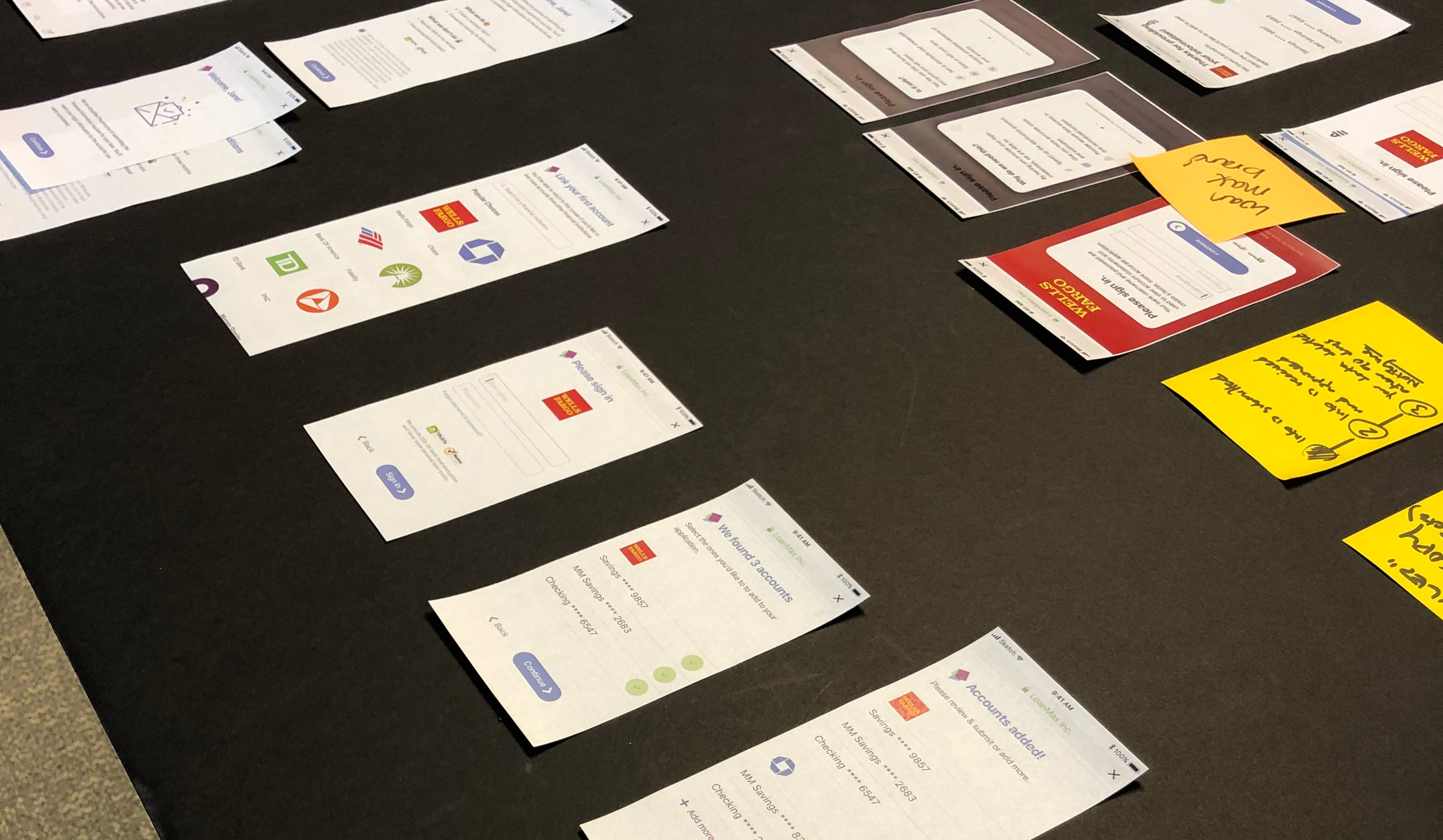

Our client has a verification of income and assets API that many large financial companies are interested in. To help them create a succesful account aggregation process, we evaluated, designed, and tested findings to improve their flow and conversion rate.

P: Verifying income & assets often takes time & money

G: Increase efficiency

P: Paper forms increases risk of false documentation and inflated reporting

G: Minimize risk

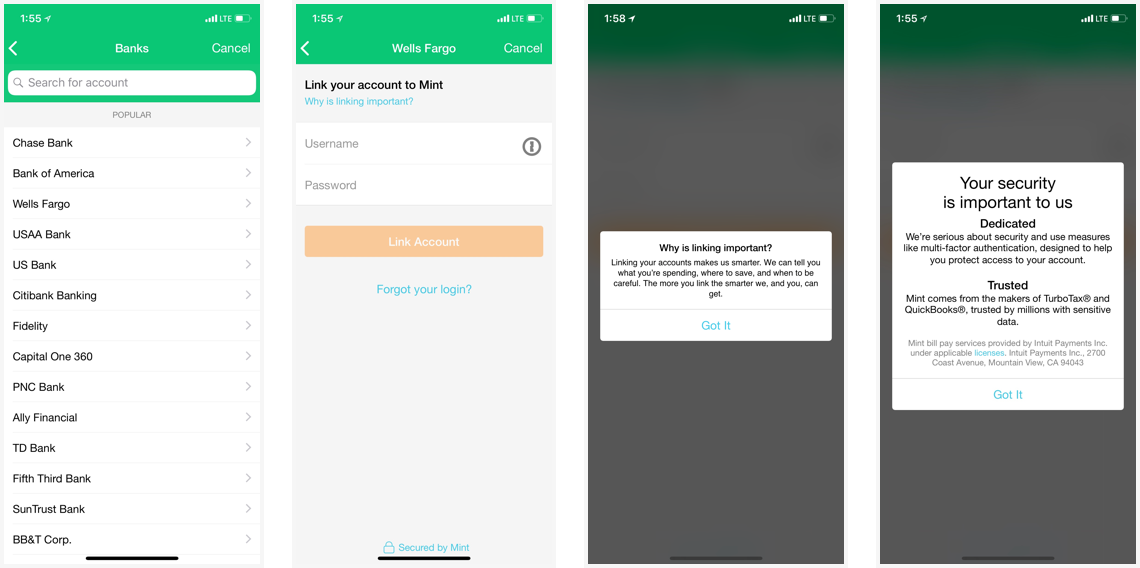

P: Consumers expect quick and easy access to credit

G: Account aggregation and personalized experiences

average cost per day currently to close a mortgage loan

of consumers are willing to securely share their login credentials to automatically pull their data

of Millennials would make a banking choice based on digital services

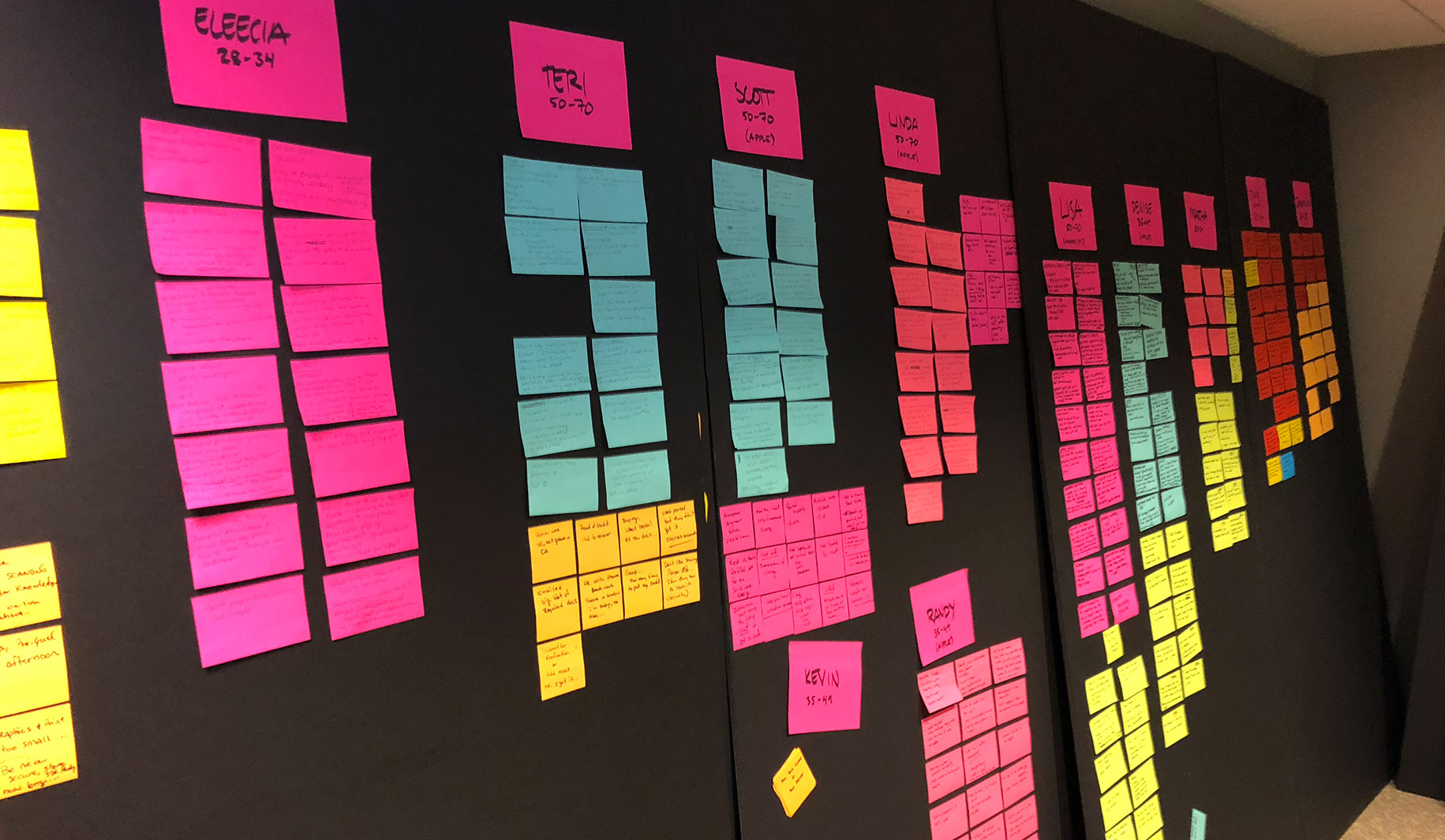

SECURITY

VALUE PROPOSITION

ACCESS & CONTROL

SETTING EXPECTATIONS

BRAND MATTERS

CONTACT ACCESS